vermont sales tax exemptions

3 Given the average sales tax rate of 6 in the state and the typical home solar system cost of 17220 most homeowners will save an average of 1033 from this solar incentive alone. The veterans town provides a 20000 exemption.

Printable Vermont Sales Tax Exemption Certificates

Managing sales tax exemption certificates is a challenge for any business but managing communications tax exemptions can be even more complex.

. Some of these exempt nonprofits must pay Vermont taxes or collect and remit Vermont taxes under certain circumstances which are described below. An eligible veteran lives in a home valued at 200000. A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501 c 3 status.

ˇ ˇ ˇ. Many federally exempt nonprofits are 501 c 3 organized for exempt purposes that include charitable religious educational scientific literary etc. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Business and Corporate Exemption Sales and Use Tax. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Vermont has 19 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Vermont has several tax exemptions on sales of tangible personal property including. This page describes the taxability of manufacturing and machinery in Vermont including machinery raw materials and utilities fuel.

Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. The effect on the education fund from the statewide property taxes is very small at 7000 Hardy said. Communications services are subject to a much broader range of federal state and local taxes fees and surcharges as well as sales tax.

Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0092 for a total of 6092 when combined with the state sales tax. 974113 with the exception of soft drinks. Their purchase and the tax paid can be written off as a business expenses on their income taxes Other states.

In Vermont certain items may be exempt from the. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. To learn more see a full list of taxable and tax-exempt items in Vermont.

How to use sales tax exemption certificates in Vermont. The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell. What is Exempt From Sales Tax In Vermont.

974114 15 16 24 Form S-3M ˇ ˆ SELLER ˆ ˇ. Exempt from sales tax on purchases of tangible personal property and meals not rooms. What is exempt from sales tax in Vermont.

S-3pdf 8943 KB File Format. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000. This page describes the taxability of clothing in Vermont.

Wednesday March 16 2022 - 1200. Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5 PDF and copy of Form ST-2 Certificate of Exemption PDF. To learn more see a full list of taxable and tax-exempt items in Vermont.

31 rows Sales Tax Exemptions in Vermont. Local jurisdictions can impose additional sales taxes of 1. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

The tax exemption currently would apply to four properties in the towns of Barton Brattleboro Swanton and Brunswick Springs Hardy said. The maximum local tax rate allowed by Vermont law is 1. Form S3 Resale and Exempt Organization Certificate of Exemption is not.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax. If a Vermont company that makes prewritten software sells to a customer in a state where this type of software is taxable the Vermont company should be collecting and remitting to that state. FOOD FOOD PRODUCTS AND BEVERAGES TAXABLE Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

ˇ BUYER ˇ ˇ ˆ ˇ ˇ ˇ ˇ ˇ ˇ ˇ ˆ ˆ EXEMPTION CLAIMED ˇ ˇ ˇ ˆ. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Form SST on this page.

Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA. Theres also a small municipal property tax implication that varies by the towns she said. In an effort to reduce the upfront cost of going solar Vermont provides a sales tax exemption for all solar equipment.

Renewable Energy Systems Sales Tax Exemption. 10 rows Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Machinery. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

The exemption reduces the appraised value of the home prior to the assessment of taxes. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. There are other types of exempt nonprofits such as 501 c 4 social.

Agricultural machinery and equipment used 75 percent of the time or more for the production of horticultural or agricultural commodities for sale. For other Vermont sales tax exemption certificates go here. The range of total sales tax rates within the state of Vermont is between 6 and 7.

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

States Without Sales Tax Article

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Sales Tax Exemptions Finance And Treasury

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Sales Tax By State Is Saas Taxable Taxjar

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States Wikiwand

Explore The Top Scoring Communities In Aarp S Livability Index Explore The Top Scoring Communities In Aarp S Livability Index Aarp Sheboygan Livability

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

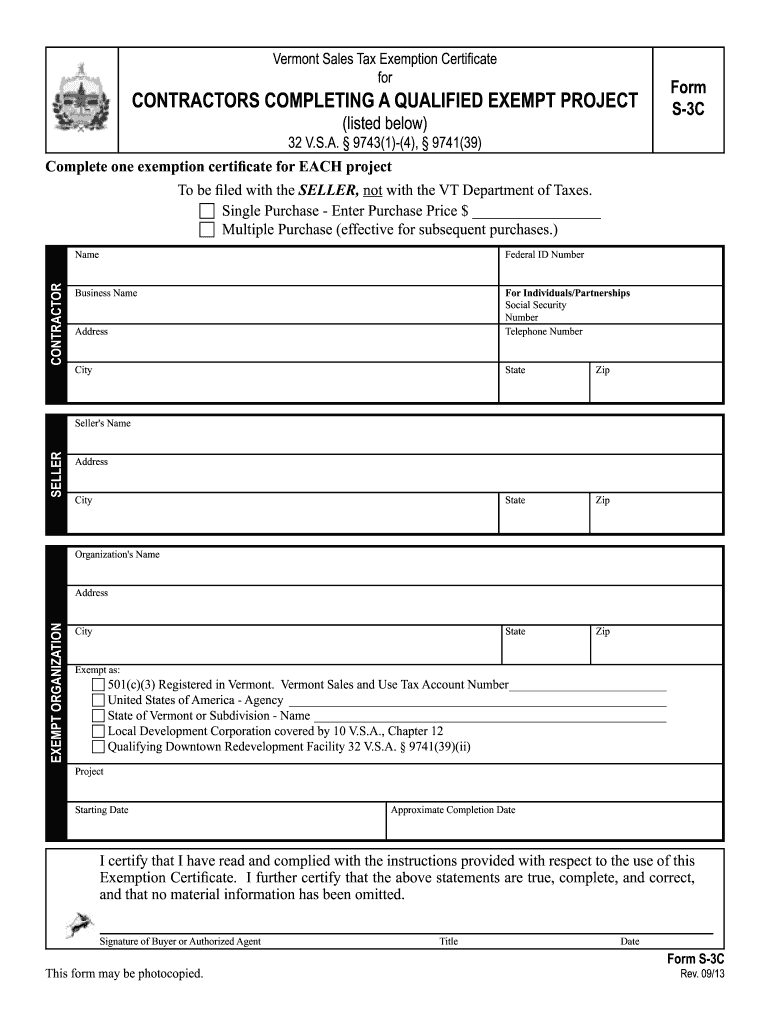

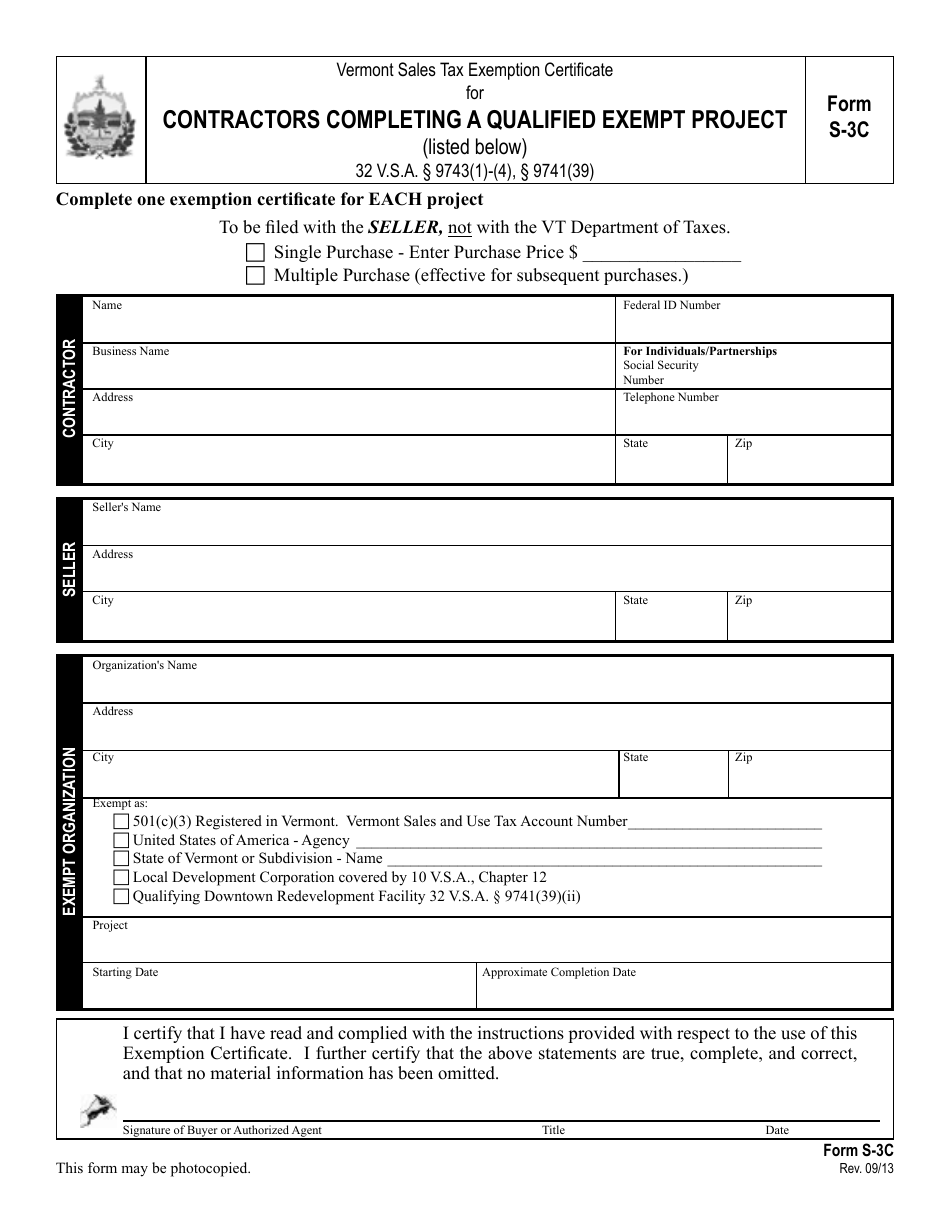

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Sales Tax Exemption Consumer Healthcare Products Association

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)